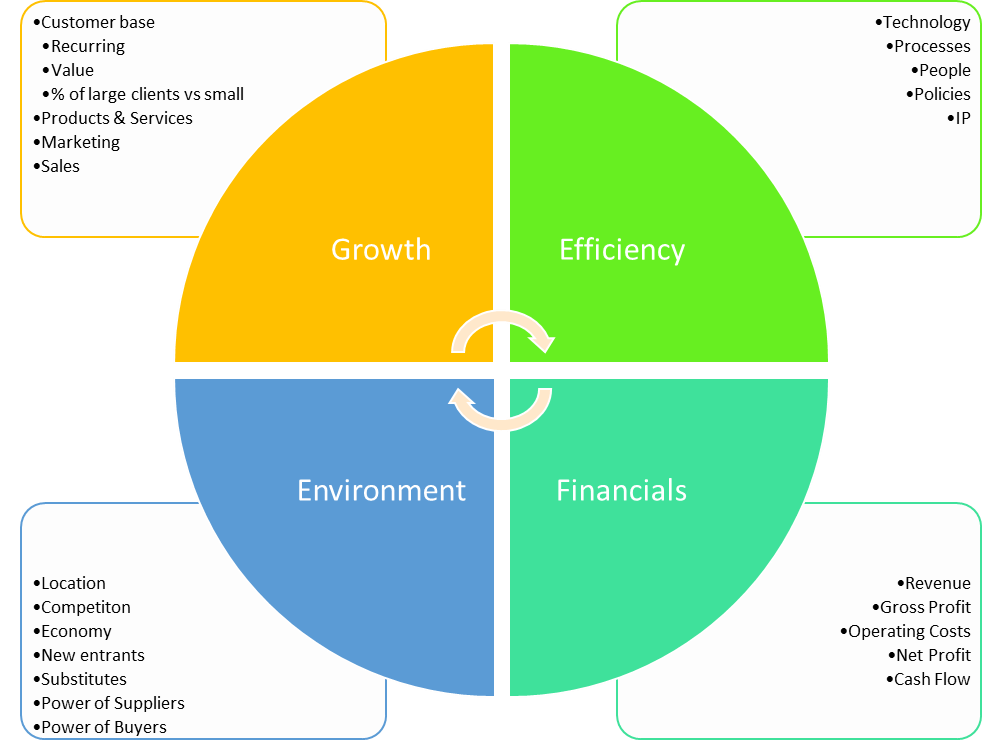

Most of us know the concept of supply and demand and its effect on the value of things. When it comes to businesses there is more at play than just supply and demand. We have come to appreciate that business value is impacted by numerous factors beyond economic factors. What follows is an outline of some of the key areas that come into play when determining how much your business might be worth.

Environment

Your business operates within a marketplace that is influenced by a number of factors which are often uncontrollable by you directly. For example, there is little that can be done to influence interest rate rises by the Reserve Bank. There is little that can be done to influence the political landscape on a day to day basis. We can’t control social trends or even technical trends which all impact our businesses. However, we can control where we locate our operations (this has become less of an issue with remote working capabilities for many) and we can control how we respond to competitor activity, or at least knowing what they’re up to. When you take a wholistic view of the marketplace within which your business operates, you can identify strategies to respond to outside factors.

Michael Porter’s 5 forces model is a great framework to apply to your market. It covers competitor activities, threats of new entrants, threats of substitutes, the power of suppliers and the power of buyers. Understanding these forces on your business is important because these forces can erode the longevity and viability of your business if there is a significant development in one or more areas.

Growth

There are 7 fundamental ways to grow your business and when you understand how they influence your business you can control specific areas to change your results. Unfortunately, business owners don’t spend enough time working on the key aspects to improve their business value until it’s too late.

Having worked with hundreds of businesses over the years, the 7 ways to grow your business apply to everyone (with some small variations). Knowing what minor tweaks and improvements can do to your profit and cash flow is critical and being able to demonstrate that to a potential buyer means higher value when you come to sell. Our FREE download report which outlines all 7 areas in detail is available for you HERE.

Efficiency

Many businesses evolve through their initial beginnings and expand on their technology, processes, policies and people in an ad hoc way. This results in inefficiencies which might be costing you unnecessarily. Reviewing these areas will typically result in finding ways to reduce costs thus increasing overall profits. Not only that, but things change as your business grows and what may have worked for you in the past might not be suitable now or into the future. Addressing these things will result in a leaner, more profitable asset that attracts a higher value.

Financials

It is concerning how few business owners truly understand their numbers and the effect on business value. When it comes time to sell your business, a potential buyer will seek to review the financial statements of the business. They will look for trends in revenue, trends in costs, and most importantly trends in profitability which is ultimately Return On Investment – ROI for the buyer.

Downward trends will impact the value negatively unless there is a substantiated reason for the downturn. For example COVID 19 affected many businesses negatively. Conversely, some businesses were never busier.

When it comes to direct costs and operating costs it is critical to review any areas where you might be able to reduce expenses. A business carrying too much expense will not be as attractive as a business that “runs a tight ship”.

What to do

The first thing to do is speak with us. We can arrange a complimentary market appraisal for your business which will give you a better understanding of what your business might get if sold on the open market. This is really useful for identifying areas you might need to work on to improve the value of your business.

Second, create a plan to improve the areas you’ve identified. We call it the “Value Improvement Plan” or VIP plan. This can take time to complete because there are so many factors to consider.

Third, make the necessary changes and measure the effect on the financials. This is the rewarding part because you will see the impact small changes can make on the bottom line and the value improvement of the business.

When to Start

Now! Call us for a complimentary market appraisal of your business and we’ll arrange a time for you to meet with us and explore where you’re at right now, where you want to be, and how to get there.

Life has a funny way of throwing up surprises. Don’t wait. You don’t know when you might need to or wake up and decided you want to sell my business.